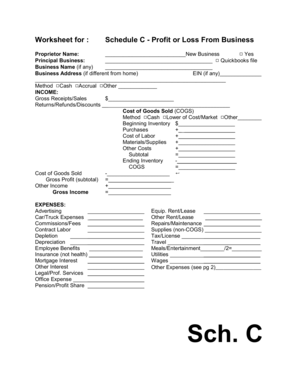

2024 Schedule C Deductions Worksheet – Investing in a solo 401(k) is a common retirement savings plan for self-employed individuals or small business owners. Let’s break down how it works, gets taxed and what potential deductions you can . How it works: There’s a line on Schedule C dedicated to reporting your advertising expenses. What else you can do: Check out the qualified business income deduction. 14. Memberships deduction If .

2024 Schedule C Deductions Worksheet

Source : www.dochub.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govFree Business Expense Tracking Spreadsheet (2024)

Source : www.betterwithbenji.comSchedule c expenses worksheet: Fill out & sign online | DocHub

Source : www.dochub.comHarbor Financial Announces IRS Tax Form 1040 Schedule C

Source : www.wwlp.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 – Money

Source : content.moneyinstructor.com2024 Form W 4P

Source : www.irs.gov2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.comWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.comSchedule C Worksheet PDF 2008 2024 Form Fill Out and Sign

Source : www.signnow.com2024 Schedule C Deductions Worksheet Schedule c expenses worksheet: Fill out & sign online | DocHub: Jeffrey “The Buckinghammer” Levine of Buckingham Wealth Partners answers a reader’s question about when it’s necessary to file a Schedule C. In this Ask the Hammer, a reader who plans to build an . Is Box 2(c) on the W-4 form “If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the Deductions Worksheet on page 3 and enter the .

]]>